31 House Members – Representing 22 Million Americans – Ask Treasury to Negotiate U.S.-Armenia Double Tax Treaty

Secretary Mnuchin Commits to Pursue Accord during Congressional Hearing

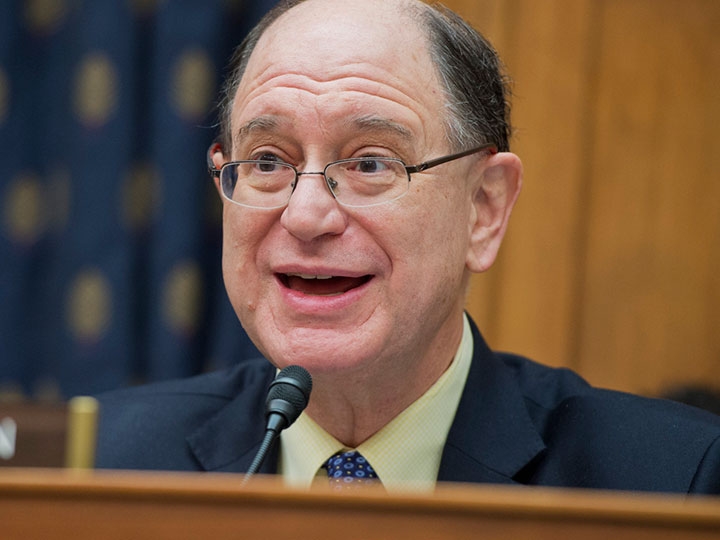

February 7, 2018WASHINGTON, DC – U.S. Treasury Secretary Steven Mnuchin received a Congressional clarion call to action from Armenian Caucus Co-Chair David Valadao (R-CA), senior Foreign Affairs Committee member Brad Sherman (D-CA), and 29 of their U.S. House colleagues to renegotiate the existing, outdated Double Tax Treaty with Armenia, an obsolete Cold War-era accord – recognized today by the U.S. but not Armenia – that was negotiated with the now defunct U.S.S.R. more than four decades ago.

On the same day, Secretary Mnuchin, responding to growing Congressional interest, testified that the Treasury Department will dedicate staff resources to pursuing a U.S.-Armenia Double Tax Treaty.

“We commend Representatives Valadao and Sherman and their colleagues – collectively representing over 22 million Americans – for taking concrete steps to eliminate obstacles to enhanced U.S.-Armenia trade by calling for a new U.S.-Armenia Tax Treaty,” said Armenian National Committee of America (ANCA) Board Member Aida Dimejian. “Beyond the immediate benefits of preventing double taxation, such an accord would reinforce the friendship of the American and Armenian peoples, facilitate the expansion of bilateral economic relations, thereby deepening Armenia’s ties to the West and providing Yerevan with greater strategic options and independence in dealing with regional powers.”

“American and Armenian business have close ties and it’s time to end the double taxation currently imposed on businesses in both nations,” explained Rep. Valadao. “By renegotiating our tax treaty with Armenia, we can continue to strengthen our relationship with a close ally while encouraging trade and investment in our great nations,” he continued.

“Modernizing our double tax treaty with Armenia is long overdue,” explained Rep. Brad Sherman (D-CA), who pressed Secretary Mnuchin on the issue during the House Financial Services Committee hearing earlier today. “This is not only an opportunity to reaffirm our friendship with Armenia, but to also create new opportunities for investment and growth.”

Joining Representatives Valadao and Sherman in calling on Secretary Mnuchin to take action are House Foreign Affairs Committee Chairman Ed Royce (R-CA), House Intelligence Committee Ranking Democrat Adam Schiff (D-CA), Congressional Armenian Caucus Co-Chairs Frank Pallone (D-NJ), Jackie Speier (D-CA) and Dave Trott (R-MI), Vice-Chair Gus Bilirakis (R-FL) and Representatives: Julia Brownley (D-CA), Salud Carbajal (D-CA), Tony Cardenas (D-CA), Judy Chu (D-CA), David Cicilline (D-RI), Mike Coffman (R-CO), Jim Costa (D-CA), Jeff Denham (R-CA), Anna Eshoo (D-CA), Tulsi Gabbard (D-HI), Josh Gottheimer (D-NJ), Ted Lieu (D-CA), Zoe Lofgren (D-CA), Alan Lowenthal (D-CA), Betty McCollum (D-MN), Jim McGovern (D-MA), Grace Napolitano (D-CA), Linda Sanchez (D-CA), John Sarbanes (D-MD), Jim Sensenbrenner (R-WI), Tom Suozzi (D-NY), Dina Titus (D-NV), and Niki Tsongas (D-MA).

The Congressional letter notes that “The existing Soviet-era treaty does not reflect the increasing complexity of a globalized world and the friendship between the American and Armenian peoples,” then calls upon Secretary Mnuchin to, “prioritize the renegotiation of the double tax treaty with Armenia.” The letter also underscores that “the complexities of the international tax structure should not discourage American and Armenian companies from conducting business with each other due to double taxation. The need for updated guidelines that reflect the current state of U.S.-Armenian relations and recently passed tax reform legislation cannot be understated.”

The full text of the Valadao-Sherman letter is provided below and online here.

Background:

Following the signing of the U.S.-Armenia Trade and Investment Framework Agreement (TIFA) in 2015, the ANCA has been working closely with a broad range of legislators to encourage the Department of Treasury to negotiate a new U.S.-Armenia Double Tax Treaty. In September 2017, the ANCA joined with Paul Korian and Peklar Pilavjian, leading U.S. investors in Yerevan’s landmark Marriott hotel, for a series of Capitol Hill and State Department meetings making the case for an updated compact. Internationally renowned Tufenkian Artisan Carpets; Triada Studio, the Armenia-based creator of the Apple Design Award-winning Shadowmatic Game; and PicsArt, the Yerevan and San Francisco based makers of one of the most popular photo-editing, collage and drawing apps, are among the many firms urging the lifting of barriers to U.S.-Armenia trade through the implementation of a new double-tax treaty.

A U.S.-Armenia Double Tax Treaty would establish a clear legal framework for investors and individuals that have business activities in both jurisdictions, preventing double taxation and facilitating the expansion of economic relations. It would also help reinforce the friendship of the American and Armenian peoples, anchoring Armenia to the West, and providing Yerevan with greater strategic options and independence in dealing with regional powers.

The U.S. has double tax treaties with many small countries, including Estonia, Jamaica, Latvia, Lithuania, Malta, and Slovenia. Armenia has double tax treaties with many advanced countries, including Austria, Belgium, Canada, China, France, Italy, the Netherlands, Poland, Russia, and the United Kingdom.

For the latest ANCA fact sheet about the benefits of an updated U.S.-Armenia Double Tax treaty, visit: https://anca.org/taxtreaty

#####

Text of the Valadao-Sherman Letter to Treasury Secretary Steven Mnuchin

The Honorable Steven Mnuchin

Secretary

U.S. Department of the Treasury

1500 Pennsylvania Avenue NW

Washington, DC 20220

Dear Secretary Mnuchin,

We are writing you with regards to the current U.S. tax treaty with the Republic of Armenia. The current tax treaty between the United States and Armenia is insufficient for the needs of the two countries, as it was last negotiated with the Union of Soviet Socialist Republics (USSR) during the Cold War in 1973.

We believe the unrealized benefits of an updated double tax treaty between Washington and Yerevan necessitate immediate negotiations, which could be based upon the frameworks of treaties recently ratified with other nations. In fact, the Armenian Embassy has said it would be “willing to conclude such an accord on the basis of the latest U.S. Model Income Tax Convention of 2016.”

The complexities of the international tax structure should not discourage American and Armenian companies from conducting business with each other due to double taxation. The need for updated guidelines that reflect the current state of U.S.-Armenian relations and recently passed tax reform legislation cannot be understated.

As Members of Congress, we respectfully urge you to prioritize the renegotiation of the double tax treaty with Armenia. The existing Soviet-era treaty does not reflect the increasing complexity of a globalized world and the friendship between the American and Armenian peoples. Furthermore, it is vital we provide businesses from both countries the ability and incentive to invest in one another.

Thank you for your service to the United States. We look forward to your response.

Sincerely,

#####