Rep. Sherman Secures Treasury Secretary Commitment to Pursue U.S.-Armenia Double Tax Treaty

Secretary Mnuchin Commits During Congressional Testimony to Assign Treasury Department Officials to Work on Bilateral Accord

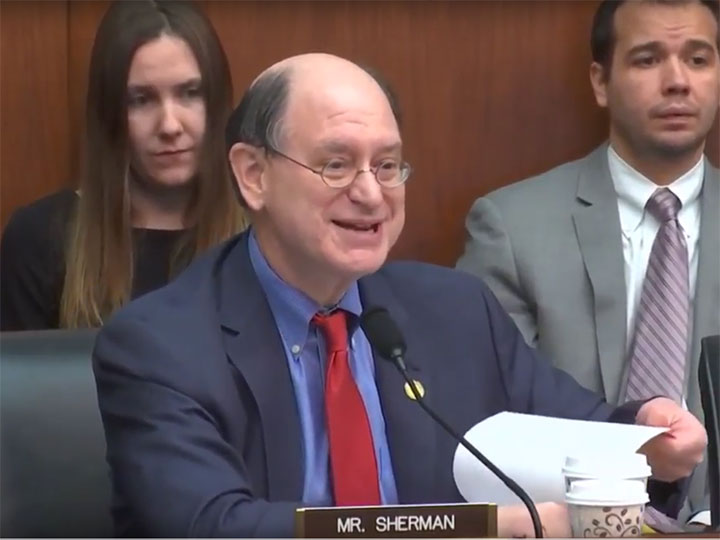

February 6, 2018WASHINGTON, DC – U.S. Treasury Secretary Steven Mnuchin, during Congressional testimony today before the U.S. House Financial Services Committee, agreed – in response to direct questioning by Representative Brad Sherman (D-CA) – to commit Treasury Department officials to pursue a new U.S.-Armenia Double Tax Treaty, a long-overdue bilateral accord that will remove barriers to the growth of U.S.-Armenia economic relations, reported the Armenian National Committee of America (ANCA).

Rep. Sherman was joined by Rep. David Valadao (R-CA) in collecting the Congressional signatures of their House colleagues on a letter to Secretary Mnuchin in support of the Tax Treaty. He referenced the legislators in his question to the Secretary, asking whether, in response to their calls to action, the Treasury Department would dedicate 28 hours (the number of Congressional signatures collected to date) to negotiating this agreement. Secretary Mnuchin replied in the affirmative, noting: “Yes, I can commit the 28 hours.”

Video of the exchange between Rep. Sherman and Secretary Mnuchin is available on the ANCA YouTube channel: https://youtu.be/NM98jAV5sOg

“We are grateful for Congressman Sherman’s policy expertise and persistence in securing the support of Secretary Mnuchin for a mutually-beneficial U.S.-Armenia Double Tax Treaty,” said ANCA Chairman Raffi Hamparian. “We look forward to the Treasury Department moving forward with this accord, a long-term ANCA priority that will – by removing the threat of double taxation – eliminate a major barrier to the growth of the U.S.-Armenia economic partnership.”

Background:

In the wake of the 2015 signing of the U.S.-Armenia Trade and Investment Framework Agreement (TIFA) in 2015, the ANCA has worked closely with a broad range of legislators to encourage the Department of Treasury to negotiate a new U.S.-Armenia Double Tax Treaty. In September 2017, the ANCA joined with Paul Korian and Peklar Pilavjian, leading U.S. investors in Yerevan’s landmark Marriott hotel, for a series of Capitol Hill and State Department meetings making the case for an updated compact. Internationally renowned Tufenkian Artisan Carpets; Triada Studio, the Armenia-based creator of the Apple Design Award-winning Shadowmatic Game; and PicsArt, the Yerevan and San Francisco based makers of one of the most popular photo-editing, collage and drawing apps, are among the many firms urging the lifting of barriers to U.S.-Armenia trade through the implementation of a new double tax treaty.

A U.S.-Armenia Double Tax Treaty would establish a clear legal framework for investors and individuals that have business activities in both jurisdictions, preventing double taxation and facilitating the expansion of economic relations. It would also help reinforce the friendship of the American and Armenian peoples, anchoring Armenia to the West, and providing Yerevan with greater strategic options and independence in dealing with regional powers.

The U.S. has double tax treaties with many small countries, including Estonia, Jamaica, Latvia, Lithuania, Malta, and Slovenia. Armenia has double tax treaties with many advanced countries, including Austria, Belgium, Canada, China, France, Italy, the Netherlands, Poland, Russia, and the United Kingdom.

For the latest ANCA fact sheet about the benefits of an updated U.S.-Armenia Double Tax treaty, visit: https://anca.org/taxtreaty

#####